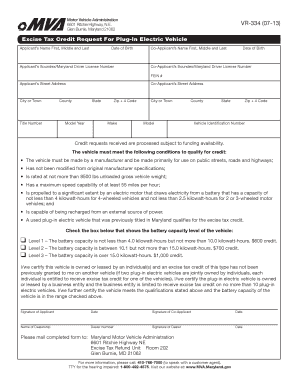

maryland ev tax credit form

Electric car buyers can receive a federal tax credit worth 2500 to 7500. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula.

. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Eligible purchase price on plug-in fuel cell. Effective July 1 2023 through June.

For example the Electric. Maryland Ev Tax Credit Form. FY23 EVSE Commercial Rebate Application Form.

While qualifying EVs and PHEVs are eligible for the federal tax credit the state of Maryland also offers unique opportunities for drivers of these types of vehicles. Tax credits depend on the size of the vehicle and the capacity of its battery. Will Fund Backlog of EV Tax Credit Applications.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. Contributions of services or labor are not eligible. On May 28 2021 Governor Hogan announced that he would allow a number of bills to become law without his signature.

If the total credits applied for exceed the. A whopping 90 of the energy consumed from transportation in the us comes from petroleum. The tax credit is equal to ten percent 10 of eligible RD expenses incurred during the taxable year in excess of the Maryland Base Amount.

The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit. For every new ev purchased for use in the. 0 of the first 8000 of the combined household.

1500 tax credit for each plug-in hybrid electric vehicle purchased. Battery capacity must be at least 50 kilowatt-hours. For more general program information.

Instructions on How to Fill Out Application Using Adobe Fill and Sign. EV Tax Credits By Barry Boggs Jr. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

Contributions of money goods or real property worth 500 or more are eligible for tax credits. One of the bills on. Electric Vehicle Supply Equipment EVSE Information Limit One Per Individual per Property EVSE Manufacturer EVSE Level Select one EVSE Model B1 EVSE Equipment Cost B2.

To qualify for the credit. The tax credit is available for all electric vehicles.

Fillable Online Mva Maryland Vr 334 06 10 Form Fax Email Print Pdffiller

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Ev Charging Rebates Incentives Semaconnect

Amazon Com Ev Wraps Maryland Hov Stickers Protection Film Automotive

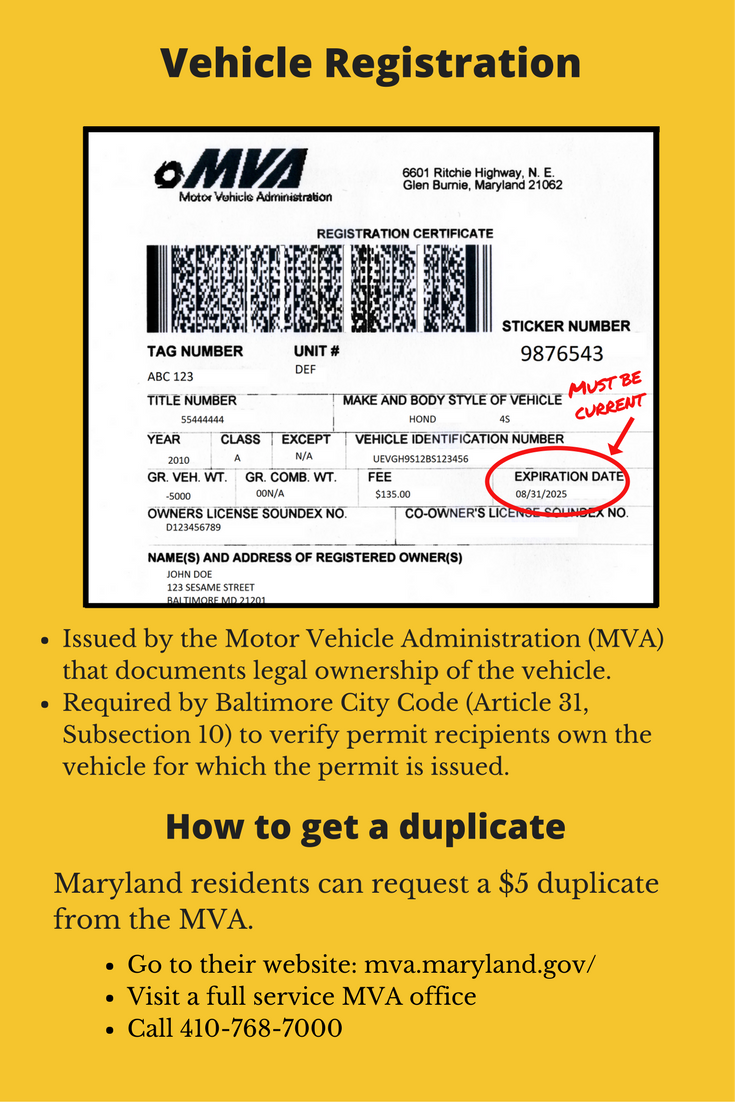

Vehicle Registration Forms Pages

Tax Update Maryland Electric Vehicle Tax Credits Are Back Travis Raml Cpa Associates Llc

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Required Customer Documents Parking Authority

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Opinion This Federal Bill Is Going To Supercharge Maryland S Energy Transition Maryland Matters

Solar Rebates Solar State Rebates Incentives

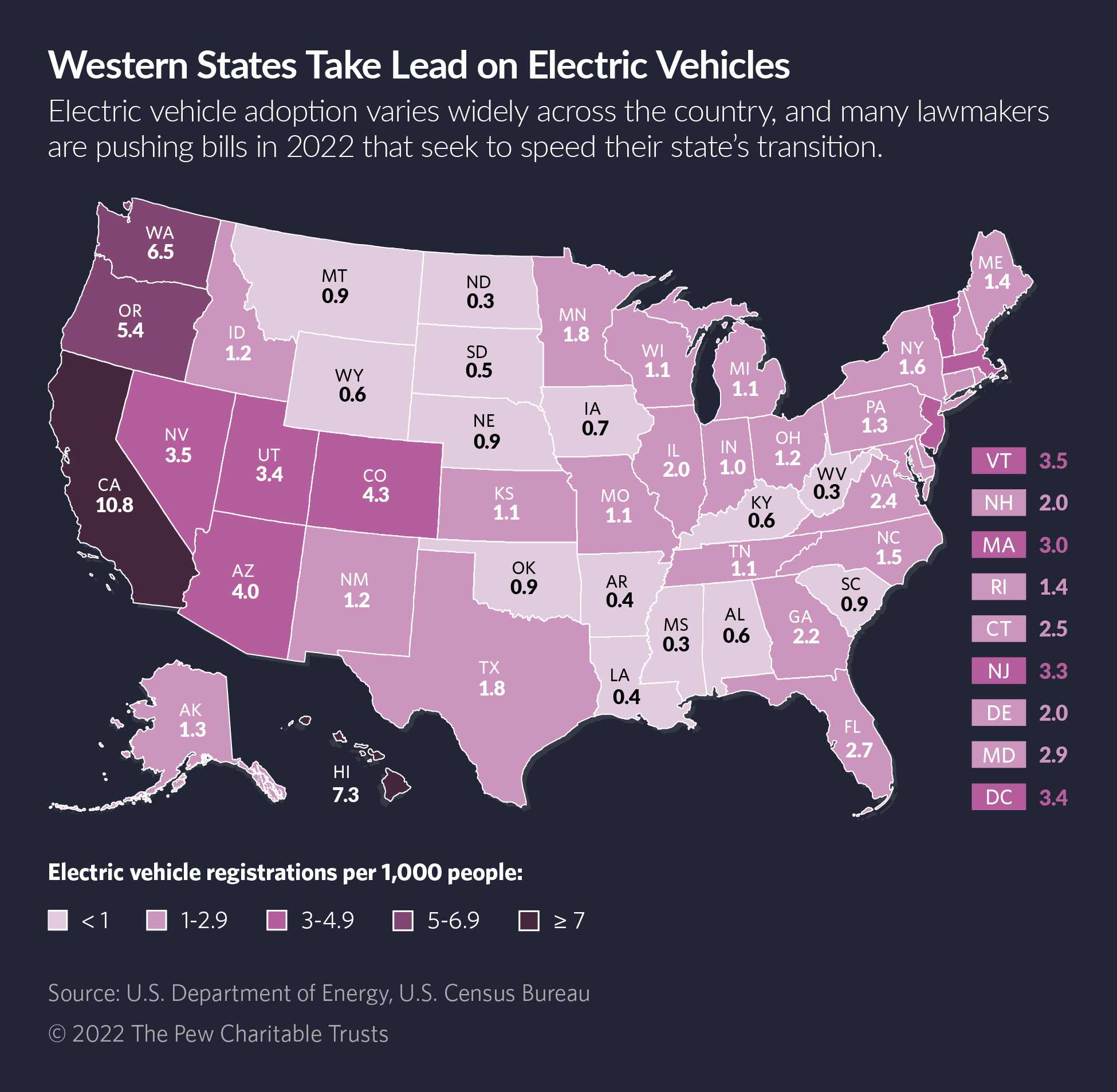

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

How Do New Ev Tax Credits Affect The Great Ev Takeover

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023