washington state capital gains tax 2020

This proposal is effective January 1 2020. No capital gains tax.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

December 21 2020.

. You must report and pay capital gains tax at the same time you file your federal income tax return. Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the Washington Legislature on April 25 2021 and signed into law by Governor Inslee on May 4 2021. The new tax would affect an estimated 58000 taxpayers in the first year.

The State has appealed the ruling to the Washington Supreme Court. The new law will take effect January 1 2022. However you must still pay the tax due on your original filing date.

Last week Washington State passed a capital gains tax aimed at the states ultra-wealthy. If you receive a filing extension for your federal taxes you will also receive a filing extension for your state capital gains tax. The sale of stocks bonds and other high-value assets that earns more than 250000 will be hit with a 7 percent tax.

The bill is part of a multi-year push by the legislature to rebalance a state tax system that it calls the most regressive in the nation in Section 1 of the bill by increasing. Washington Capital Gains Tax to Fund Education Initiative 2020 The Washington Capital Gains Tax to Fund Education Initiative was not on the ballot in Washington as an Initiative to the Legislature a type of. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021. A landmark 2018 report by the Institute on Taxation and Economic Policy found that.

This tax only applies to individuals. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations on itemized deductions which increases the tax rate by 118 percent. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid.

We purchased the home November 2020 for 397000 and would possibly sell for 500000 this year. For the tax to kick in an individual. A capital gains tax of 7 is imposed on long-term capital gains of individuals in Washington starting on January 1 2022.

Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. Real estate retirement savings accounts livestock and timber are exempt for capital gain taxation.

But the good news is that there is no state income tax in Washington making it an attractive place to sell your home. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid.

Filed by the Washington and American Bankers Associations last year the lawsuit concerns the states 12 business and occupation BO tax on banks earning 1 billion a year in the state. While the appeal is pending the Department will continue to provide guidance to the public regarding the tax as a. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

Uncle Al March 4 2022 at 424 pm. What Inslees proposing is a 9 percent tax on capital gains earnings above 25000 for individuals or 50000 for joint filers that would. The law generally imposes a 7 tax on net long-term capital gains in excess of 250000 recognized during each calendar year.

Washington state recently enacted a new capital gains tax set to begin January 1 2022. Sole proprietor income retirement accounts homes farms and forestry are exempt. The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments if the gains exceed 250000 annually. The tax is generally imposed on Washington resident individuals but the tax may also apply to nonresidents of Washington. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations on itemized deductions which increases the tax rate by 118 percent.

The tax is levied only on profit over that 250K threshold. Washington state lawmakers were down to the wire Sunday on the last day of the 2021 session as they passed bills creating a new tax on capital gains and one creating a low-carbon fuels standard. 5096 which was signed by Governor Inslee on May 4 2021.

Up to 15 cash back Wondering about Washington state Capitol gains tax our house we purchased the home November 2020 for 397000 and - Answered by a verified Tax Expert. The new law will take effect January 1 2022. The tax is historic because Washington despite its progressive reputation until now had the worst tax code in the nation when it comes to fairness behind Texas Florida and South Dakota.

Additional State Capital Gains Tax Information for Washington. In general taxes seem confusing and if you didnt already know Washington does tax capital gains and property. Overview of Washington State Capital Gains Tax.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. Selling a house in Washington involves many steps and things to consider especially taxes.

How Do State And Local Individual Income Taxes Work Tax Policy Center

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

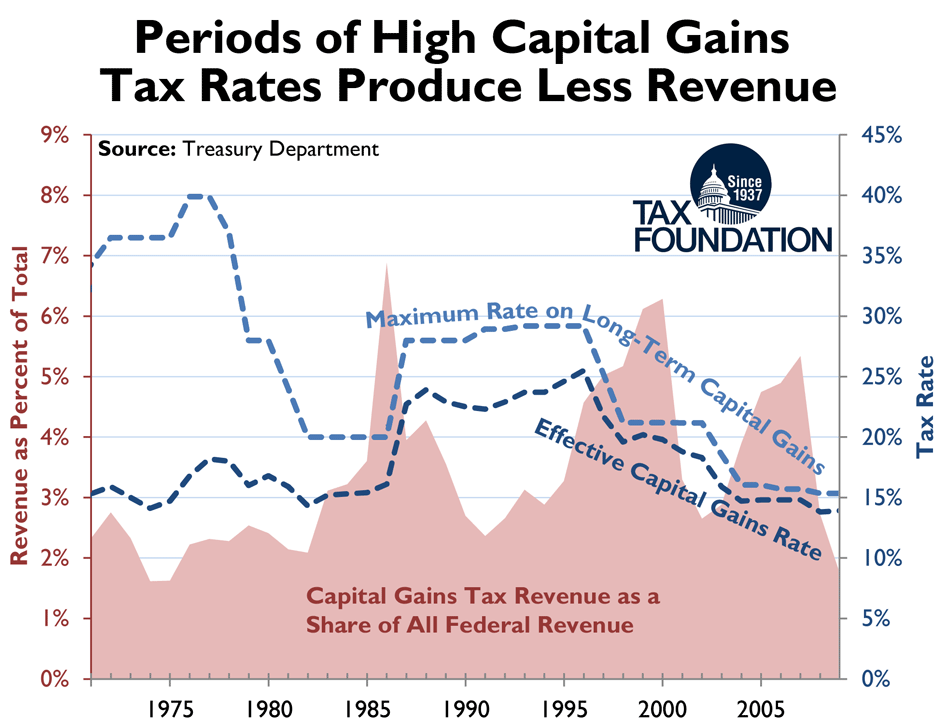

Reagan Showed It Can Be Done Lower The Top Rate To 28 Percent And Raise More Revenue Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Double Taxation Definition Taxedu Tax Foundation

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

Wa Capital Gains Tax Ruled Unconstitutional By Trial Judge Crosscut

Capital Gains Tax Calculator 2022 Casaplorer

What Are Capital Gains Robinhood

2021 Capital Gains Tax Rates By State

Spain Cryptocurrency Tax Guide 2022 Koinly

Capital Gains Tax Rates By State Nas Investment Solutions

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

The States With The Highest Capital Gains Tax Rates The Motley Fool